To make money from Forex trading in Nigeria and Africa, you must first understand the fundamentals of the foreign exchange market and how it can be a powerful avenue for generating consistent income. Forex, or foreign exchange trading, allows you to trade currency pairs, such as the Nigerian naira against the US dollar, and potentially earn significant profits by taking advantage of fluctuating currency values.

In this guide, I will walk you through the key steps to profit from Forex trading, using relevant strategies, tools, and trusted brokers in the African context, particularly Nigeria.

Steps to get Started with Forex Trading:

Table of Contents

1. Understanding Forex Trading :

When you venture into Forex trading, you’re stepping into the largest and most liquid financial market in the world. With over $7 trillion traded daily, Forex presents an incredible opportunity for you to build a potentially profitable business. In this market, you’ll be buying and selling currencies, aiming to make a profit by capitalizing on the price differences that occur between currency pairs.

For instance, in Nigeria, where the naira often fluctuates against the US dollar, you can seize opportunities for significant gains. By purchasing US dollars when the naira is weak, and selling when the naira strengthens, you can generate profit from those exchange rate movements. This gives you a chance to take advantage of economic shifts, while also earning in a strong foreign currency.

All of your Forex transactions will be conducted online through brokers who provide access to the global market. These brokers are your gateway to trading currencies like the US dollar, Euro, British pound, and more. Many Nigerians, like yourself, have already embraced Forex trading as a way to earn income in foreign currencies, which helps safeguard against the depreciation of local currency. By entering the Forex market, you can not only protect your income from local currency devaluation but also gain access to a world of financial possibilities.

2. Setting Up for Success in Forex Trading:

As you prepare to dive into Forex trading, it’s essential to set yourself up for success by taking a few key steps. First and foremost, ensure that you have a reliable and stable internet connection. Since Forex trading involves constant real-time updates in currency prices, any delay or disruption caused by a poor connection could lead to missed opportunities or incorrect trade executions. In a fast-moving market like Forex, where every second counts, a stable internet connection is one of your most valuable tools.

Next, understand that Forex trading is not something you can master overnight. It’s a skill that, like any professional field—whether law, medicine, or engineering—requires learning and practice. You will need to invest time in educating yourself, honing your strategies, and understanding market dynamics. Trading without the necessary knowledge is like trying to navigate in the dark—you risk unnecessary losses and missed potential.

If you’re new to Forex, I suggest you begin by exploring free educational platforms like BabyPips. BabyPips offers online courses tailored to both beginners and advanced traders, covering everything from the basics of how the Forex market works to more complex trading strategies. This will help you build a strong foundation, giving you the knowledge and confidence you need to make informed trading decisions.

3. Choosing the Right Broker for Forex Trading:

Your success in Forex trading is closely tied to the broker you choose, making this decision one of the most critical steps in your trading journey. A good broker provides favorable trading conditions, including low spreads, flexible leverage options, and a dependable trading platform.

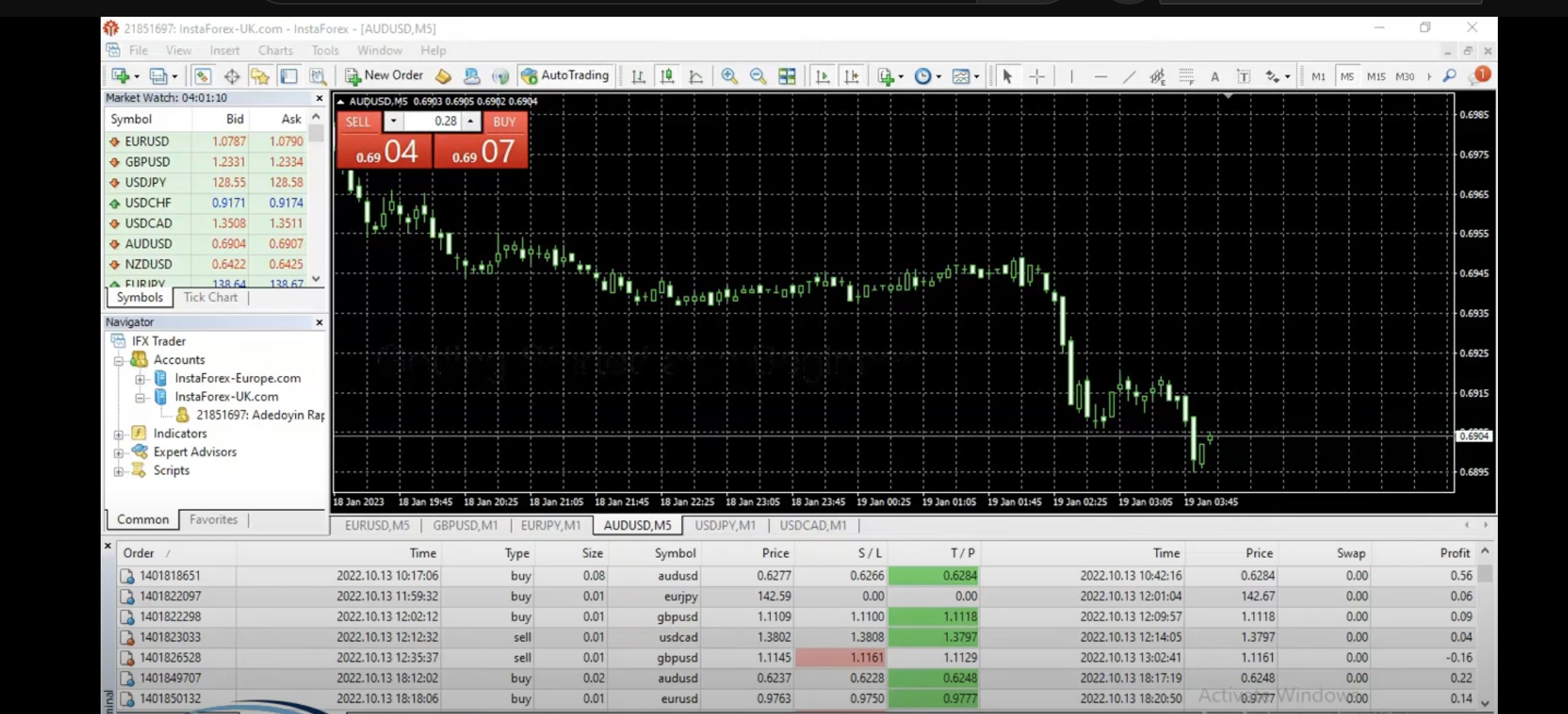

In Nigeria and across Africa, some popular brokers include FBS, OctaFx, InstaForex, FXTM, and Deriv. However, before committing to any broker, there are several factors you need to carefully consider to ensure you’re making the right choice for your specific trading needs.

First, examine the spreads offered by the broker. Spreads represent the difference between the buying and selling prices of currency pairs, and they directly affect your trading costs. Some brokers offer fixed spreads, meaning that the cost of trading remains consistent even in times of high market volatility. Others offer variable spreads that fluctuate with market conditions. I recommend looking for a broker with competitive spreads, as this will minimize your trading costs and maximize your profit potential.

Next, consider the leverage options available. Leverage allows you to control a much larger position than your actual capital would otherwise permit. For instance, a leverage of 1:100 means that with just $100, you can control a $10,000 position. While leverage can significantly amplify your profits, it also increases the risk of loss. Make sure you fully understand how leverage works before using it, and avoid high leverage ratios if you’re still learning the ropes. It’s essential to balance the potential for gains with the possibility of magnified losses.

Another important aspect is the type of accounts the broker offers. Most brokers provide different account types, such as micro, mini, and standard accounts. Micro accounts are suitable for beginners as they allow you to trade with a smaller amount of capital, while standard accounts are for more experienced traders who are comfortable with higher risk. Choose an account type that aligns with your current skill level and financial goals.

Finally, always ensure that the broker you choose is regulated by a reputable financial authority. Regulation is vital for protecting your investments and ensuring that the broker operates in a transparent and trustworthy manner. For example, brokers regulated by respected bodies like the UK’s Financial Conduct Authority (FCA) or Australia’s Australian Securities and Investments Commission (ASIC) are more likely to adhere to strict guidelines that safeguard your funds.

By carefully evaluating each of these factors—spread, leverage, account types, and regulation—you’ll be better equipped to choose a broker that fits your needs, setting the stage for a successful Forex trading experience.

4. Trading Strategies for Success:

To achieve consistent success in Forex trading, you need to develop a solid strategy that fits your trading style and financial goals. Without a well-thought-out approach, you could risk making emotional decisions that lead to losses.

Fortunately, there are several proven strategies you can use to guide your trades. The key is to find one that aligns with your risk tolerance, time commitment, and market understanding. Here are a few strategies that I recommend you explore:

Scalping

If you prefer fast-paced trading, scalping could be the ideal strategy for you. Scalping involves making numerous small trades within a very short period, usually minutes or even seconds. The goal is to accumulate small but frequent profits that add up over time. This strategy demands constant attention to the market, as you’ll need to enter and exit trades quickly to capitalize on brief price movements. It’s suitable for those who can dedicate significant time to monitoring price charts and executing trades rapidly.

Day Trading

If you’re not comfortable holding trades overnight, then day trading is a strategy you should consider. Day trading involves opening and closing all of your trades within the same day, usually within a few hours. By the end of each trading day, you’ll have no open positions, which means you won’t be exposed to overnight market volatility. Day trading can be more relaxed than scalping but still requires you to keep an eye on the market throughout the day. If you prefer not to leave positions open for long periods but want more flexibility than scalping, day trading is a balanced option.

Swing Trading

If you don’t have the time to monitor the market constantly, swing trading may be a better fit for you. With this strategy, you hold trades for several days or even weeks, aiming to profit from longer-term market trends. Swing trading allows you to take a more measured approach, as you’re focusing on broader market movements rather than small, quick fluctuations. This strategy is perfect for you if you have a busy schedule but still want to engage in Forex trading and capitalize on larger market shifts.

Trend Trading

Trend trading is one of the most straightforward yet effective strategies. It involves trading in the direction of a market trend—either upward (bullish) or downward (bearish). The goal is to ride the trend for as long as possible, then exit the trade when signs of a reversal start to appear. Trend trading can be applied over various timeframes, from short-term intraday trading to long-term investments. If you prefer a strategy that aligns with market momentum and doesn’t require constant monitoring, trend trading may be a strong choice for you.

Each of these strategies has its advantages, and the best one for you depends on how much time you can dedicate to trading and your risk tolerance. I recommend that you start by experimenting with these strategies in a demo account to see which one fits your style before committing real funds. Finding the right strategy is a key step toward long-term success in the Forex market.

5. Managing Risks:

When engaging in Forex trading, it is crucial that you prioritize risk management. While the market offers opportunities for profit, it also carries inherent risks, and if you don’t manage these risks effectively, you could face significant losses. One of the first principles I want to emphasize is that you should only trade with capital that you can afford to lose. Forex trading can be volatile, and not every trade will go in your favor, so it’s important to protect yourself from financial hardship by setting aside funds specifically for trading.

A practical way to manage risk, especially if you’re just starting out, is by using demo accounts. Most brokers offer demo accounts that allow you to practice trading with virtual money, which means you can experience real market conditions without putting your actual funds at risk. Demo trading helps you build your skills, test strategies, and understand market behaviors without any financial consequences. I highly recommend that you use this tool before you dive into live trading with your own money.

In addition to using demo accounts, I encourage you to be cautious with leverage. Leverage can seem appealing because it allows you to control a large position with a small amount of capital, increasing your potential for higher profits. However, leverage also amplifies your losses if the market moves against your position. To minimize this risk, start with low leverage, and only increase it as you become more experienced and confident in your trading decisions. By approaching leverage with care, you protect yourself from unnecessary exposure to large losses.

6. Deposits, Withdrawals, and Payment Systems:

As you begin to make profits in Forex trading, one of your key priorities will be ensuring that you have a reliable and efficient way to both deposit funds and withdraw your earnings. In Nigeria and across Africa, most Forex brokers offer a variety of payment options, so you’ll need to choose the ones that best suit your needs and financial preferences.

Popular methods of deposit and withdrawal include traditional options such as Visa and MasterCard, which are widely accepted by most brokers. If you prefer to use your local bank for transactions, many brokers also facilitate online bank transfers. This method is convenient and secure, as it allows you to move money directly between your bank account and your trading platform.

In addition to these standard payment methods, you can also use e-payment systems like Skrill, Neteller, and Perfect Money. These platforms provide fast, seamless transactions and are especially useful if you want to avoid delays that can sometimes occur with bank transfers. E-payments are commonly used by traders who prefer a quicker way to access their funds without the processing time required for traditional banking methods.

For those who are comfortable with digital currencies, many brokers also accept cryptocurrency payments, such as Bitcoin. Using cryptocurrency for deposits and withdrawals can be advantageous because of the speed and global accessibility it offers, especially if you’re looking to avoid the complexities of currency conversions and international banking regulations.

When selecting a broker, I encourage you to make sure that they offer fast, secure, and convenient deposit and withdrawal options that match your preferred payment method. Always confirm whether there are any fees associated with transactions and how long withdrawals typically take to process. By ensuring your broker provides a smooth payment process, you can focus on trading and enjoying the profits you earn with peace of mind.

7. My Caution Advice:

To make consistent money from Forex trading in Nigeria or Africa, focus on continuous learning, practice, and sound risk management. Equip yourself with the right tools and choose a reliable broker that aligns with your trading goals. While Forex trading offers significant profit potential, it’s important to remember that past performance does not guarantee future results. Always trade cautiously and be prepared to adapt your strategy as you gain more experience.

The Common Forex Trading Terms

In Forex trading, you’ll frequently encounter specific terms that are key to understanding how the market works. Let me guide you through some of the most common Forex trading terms, so you can feel confident as you trade.

- Pip (Percentage in Point): A pip is the smallest price movement in the Forex market, typically representing a 0.0001 change in the price of a currency pair. For example, if the EUR/USD pair moves from 1.1000 to 1.1001, it has moved by one pip.

- Spread: The spread refers to the difference between the buy (ask) price and the sell (bid) price of a currency pair. A lower spread indicates better trading conditions as it means lower transaction costs.

- Leverage: Leverage allows you to control a larger position with a smaller amount of money. For instance, if your broker offers a leverage ratio of 1:100, you can control $100,000 with just $1,000 of your own money. Leverage amplifies both your potential profits and potential losses.

- Lot Size: A lot is the standard unit of measurement in Forex trading. A standard lot equals 100,000 units of the base currency. There are also mini lots (10,000 units) and micro lots (1,000 units), allowing you to trade smaller amounts depending on your capital.

- Currency Pair: In Forex, currencies are traded in pairs, such as EUR/USD. The first currency (EUR) is the base currency, and the second currency (USD) is the quote currency. When you trade, you’re essentially buying the base currency and selling the quote currency.

- Bid Price: The bid price is the price at which you can sell a currency pair. It’s the highest price a buyer is willing to pay for a currency at a given time.

- Ask Price: The ask price is the price at which you can buy a currency pair. It’s the lowest price a seller is willing to accept.

- Margin: Margin is the amount of money you need to deposit with your broker to open a leveraged trading position. It acts as collateral for the leveraged funds provided by the broker.

- Stop Loss: A stop-loss order is used to automatically close a trade once the market price reaches a certain level, preventing further losses. It’s a key risk management tool to protect your account from significant losses.

- Take Profit: This is an order placed to close a trade once a certain profit level is reached. It ensures you lock in your profits before the market reverses.

- Slippage: Slippage occurs when there is a difference between the expected price of a trade and the actual price at which it is executed. This usually happens in volatile markets when prices change rapidly.

- Bear Market: A bear market occurs when prices in the Forex market are falling or are expected to fall. Traders who anticipate this usually sell currencies, expecting to buy them back at a lower price.

- Bull Market: A bull market is when prices are rising or are expected to rise. Traders generally buy currencies in anticipation of selling them at a higher price.

- Long Position: If you take a long position, you are buying a currency pair in anticipation that its price will rise. For example, going long on EUR/USD means you expect the euro to strengthen against the US dollar.

- Short Position: Taking a short position means you are selling a currency pair because you expect its price to fall. Going short on EUR/USD means you believe the euro will weaken against the US dollar.

By understanding these basic terms, you’ll be better equipped to navigate the Forex market, make informed decisions, and communicate effectively with other traders.

Why Do Forex Traders Fail?

Forex trading offers the potential for substantial profits, but many traders end up failing for various reasons. Let me explain some of the key factors that contribute to failure in Forex trading, so you can be better prepared to avoid common pitfalls.

- Lack of Proper Education: One of the main reasons traders fail is that they dive into the market without fully understanding how it works. Forex trading requires a solid understanding of financial markets, technical analysis, and trading strategies. Without this knowledge, you are more likely to make poor decisions that lead to losses. It’s important to educate yourself and practice on demo accounts before risking real money.

- Emotional Trading: Emotions like fear, greed, and overconfidence can cloud your judgment and lead to poor decisions. For example, a trader may close a profitable trade too early out of fear or hold onto a losing trade too long, hoping the market will reverse. Successful trading requires discipline and a calm, logical approach, even in the face of losses.

- Over-Leveraging: While leverage allows you to control large positions with a small amount of capital, it also increases your risk. Many traders fail because they use too much leverage, leading to significant losses when the market moves against them. Using high leverage amplifies both potential profits and potential losses, and many traders fail because they underestimate the downside risk.

- Poor Risk Management: Proper risk management is essential to long-term success in Forex trading. Many traders fail because they don’t manage their risk effectively. This includes not using stop-loss orders to limit potential losses, risking too much on a single trade, or trading without a clear plan. Always ensure that you’re only risking money you can afford to lose and that your trades are calculated based on sound strategies.

- Lack of a Trading Plan: Successful traders operate with a well-thought-out trading plan that outlines their strategies, risk tolerance, and goals. Many traders fail because they lack a clear plan and trade based on impulsive decisions or “gut feelings.” Without a plan, it’s easy to make emotional decisions that lead to failure.

- Unrealistic Expectations: Some traders enter the Forex market expecting to make quick, easy money, but the reality is that consistent success requires time, patience, and skill. Traders who chase unrealistic profits or think they will become rich overnight are more likely to take excessive risks and ultimately lose money.

- Failure to Adapt to Market Conditions: The Forex market is highly dynamic and can be influenced by a wide range of factors such as economic news, political events, and market sentiment. Traders who fail to adapt their strategies to changing market conditions often struggle to succeed. It’s essential to stay updated on global events and understand how they impact currency prices.

- Neglecting Psychological Preparation: Trading can be mentally exhausting, especially when dealing with losses or market volatility. Many traders fail because they are not mentally prepared to handle the stress that comes with trading. They may become overwhelmed by losses or make irrational decisions during market turbulence. Having the right mindset, resilience, and patience is just as important as having a good strategy.

- Trading Without Patience: Patience is crucial in Forex trading. Impatient traders often jump into trades without waiting for proper signals or exit too early before a trend has fully developed. You need to give trades time to work out and not rush to make quick profits.

- Ignoring Economic Data and News: The Forex market is heavily influenced by economic data releases and geopolitical events. Traders who fail to stay informed about major news events or disregard the impact of economic indicators often make misinformed decisions. Successful traders pay close attention to news and use it to adjust their strategies.

By addressing these issues and focusing on risk management, psychological preparation, and continuous learning, you increase your chances of becoming a successful Forex trader.

Recommended Articles: